The India Insight

A newsletter dedicated to delivering key insights, trends, and thought-provoking articles on the Indian and Global economy focusing on the Equity, Debt and Commodity Markets.

Feel free to share your opinion in the comments.

Disclaimer: I'm not a SEBI registered advisor, and all views shared are personal. Kindly consult your investment advisor before making any decisions.

The current state of the economy:-

At the time I am writing this newsletter, the Inauguration of the new president of the United States of America is going to be live in less than two days, while the newly launched cryptocurrency named Trump launched on the Solana blockchain has led to the Market valuation of the meme coin has soared to $70 Billion while you may be wondering well this was launched yesterday and is already valued more than HUL, ITC.

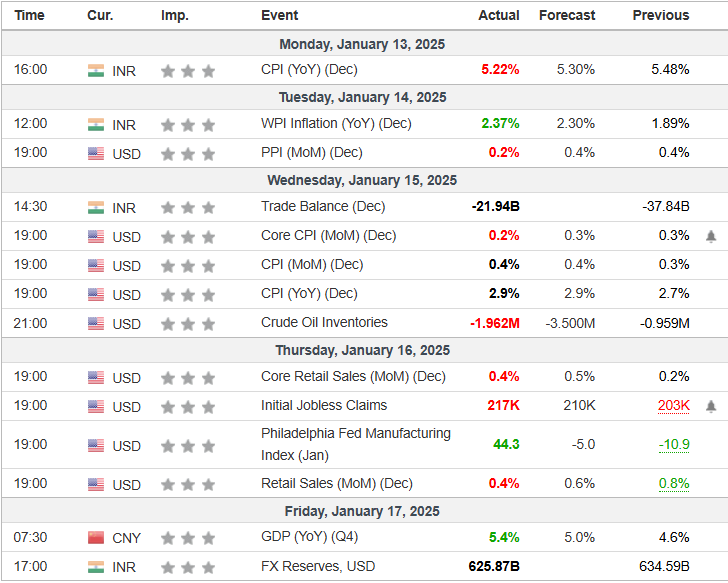

Monday

This week, the Ministry of Statistics and Programme Implementation (MoSPI) released the Consumer Price Index for December. The CPI came below the street estimate of 5.3%, which led to relief for the central bank as the central bank inflation range of +-4 (2-6), boosted the belief of a rate cut in February. The Year on Year data showed that the Cereal prices stood at 6.51% after rising by 6.9% in November. Inflation for meat and fish was 5.3% compared to a rise of 4.7% in the previous month. Inflation in milk rose 2.8% after rising by 2.9% in the preceding month. Inflation in pulses rose 3.83% after rising by 5.4% last month. Clothing and footwear inflation rose 2.74% compared to a rise of 2.8% previously. For personal care products, inflation remains high at 9.7%, which has been the factor that has kept FMCG demand under a cloud, as stated by some companies, said Madan Sabnavis, chief economist at Bank of Baroda. Higher input costs have been responsible for this increase in prices, he added.

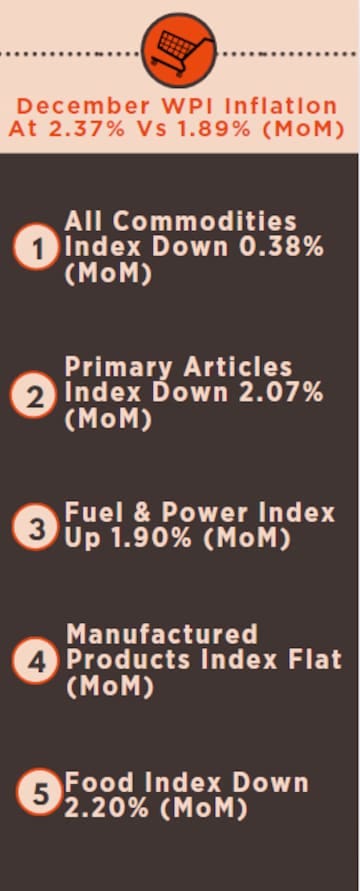

Tuesday

The data for the Wholesale price index (WPI) was also reported, which exceeded the street expectations and dampened the chances of a rate cut in February. While the WPI inflation increase shows how the wholesalers have increased the prices, it strongly affects consumer inflation. Below is an image of the basket of goods in the subcategories on an MoM basis.

The Bureau of Labour Statistics also reported the data for the Producers price index of United States of America, which came below the street's expectation by a significant margin, approximately missing by 20 bps. It was a positive signal for the bondholders as the yields fell after that, showing how the rate cut expectations changed. A FED member also said in a conference that there could be 3-4 rate cuts this year, while he said it would be based on incoming data. The PPI data came below estimates, leading to a spike of a rate cut in the March FED meets. The decrease in PPI shows how a change in the input cost for a producer might lead to a reduction in the prices for the end person as the wholesaler passes the relief to the consumer. The PPI increased, though, which is a good sign as it shows the economy is not slowing or going into deflation state, but it is showing signs of cooling down.

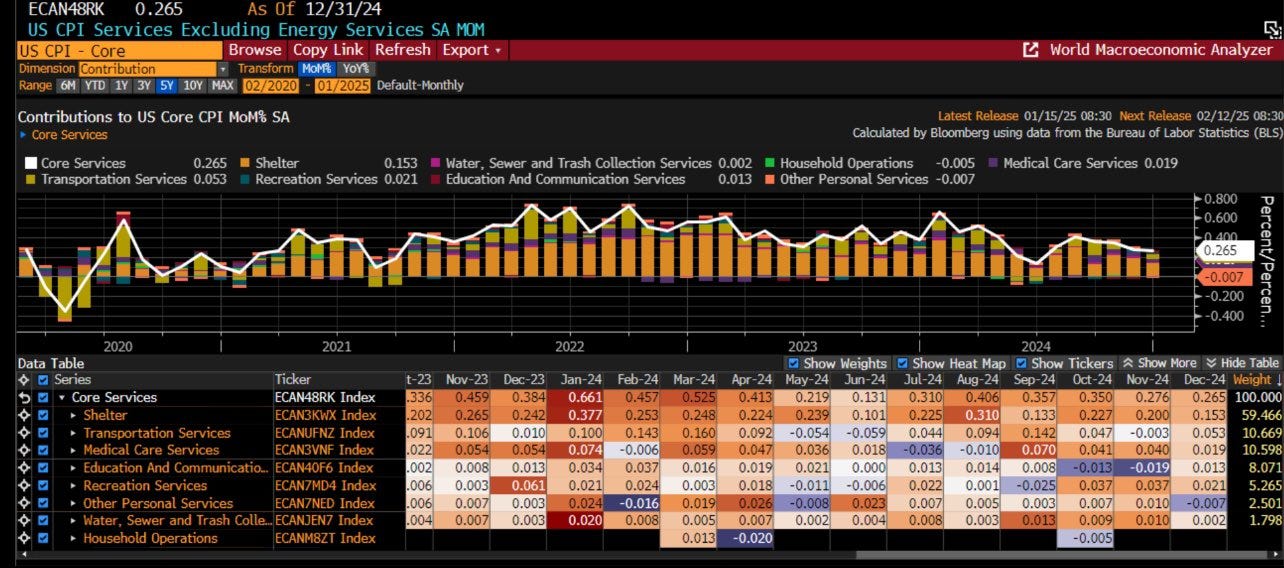

Wednesday

The consumer price index for the United states of America was released. The data came in line with the estimates as the PPI, which came below expectations, showed a positive sign, where the CPI can also be below estimates or in line while the expectation of a beat decreased; the Consumer price index data of the below image shows the changes where the shelter was the main driver of CPI.

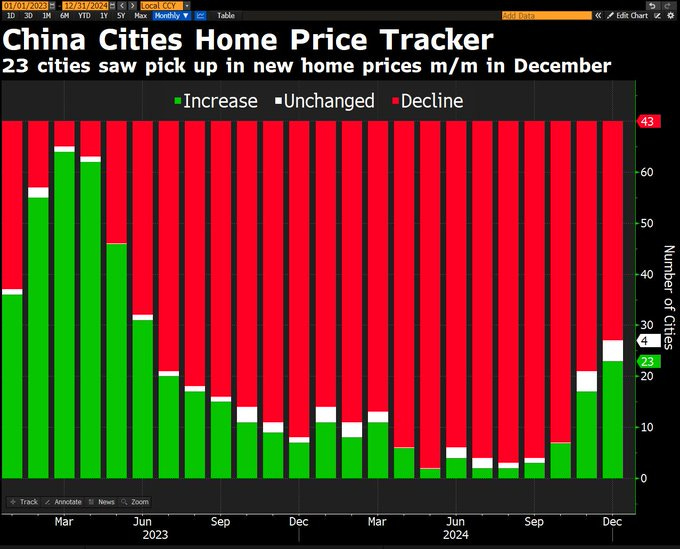

The core CPI (excluding food and energy) also came below expectations, showing the cooling of demand in sectors other than energy and food, as shown in the above image. At the same time, this is the last CPI data that came before the POTUS inauguration. At the same time, President Trump has pledged to put tariffs on countries like China, Vietnam, and Canada while imposing a 60% tariff on China. At the same time, the trade tensions have escalated, led by both sides, while the USA is restricting High-end chip access to China, and TikTok is no longer available in the United States of America (Is America a free nation?). At the same time, China banned the export of different minerals, and tensions between the two biggest superpowers of the world have been high. China has been grappling with internal demand while real estate is suffering. The recent stimulus introduced aimed to boost the demand in the economy is showing signs of recovery. Early signs of a recovery in China's housing market. To emphasize, these are very early signs. Nonetheless, the turn in the data is worth noting. Last September's central policy pivot has had an effect, albeit modest, thus far.

Thursday

The retail sales data came below expectation, showing the cooling of demand in the economy as evident in the released data (CPI, PPI). For more information, look for the below image:-

Friday

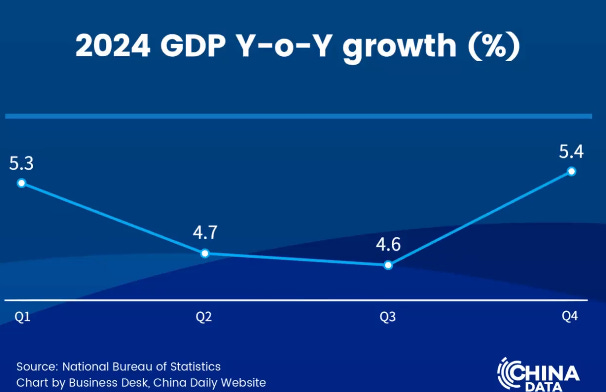

China's Gross Domestic product, expected to be 5%, came at 5.4%, beating the analyst estimates by 40 bps.

The FX reserve data was also released as continued from the previous month. The forex reserves decreased from 658 billion dollars to 634 billion dollars. At the same time, traders speculated that the Central Bank had been selling the dollar in the open market to support the rupee. The outgoing Governor, Shaktikanta Das, used a good amount of reserves to protect the rupee. While the REER has been near its high, the new governor looks freer while letting the rupee move more freely, which will also save crucial foreign reserves as DXY has been strengthening.

The new Trump administration

President Trump will soon be inaugurated as the new President of the United States. This has brought inflation expectations high in the United States, with bond yields increasing in the shorter term and more so in the longer term bonds (US02Y, US10Y). The Trump administration has promised to deliver a corporate tax rate in the United States, which will lead to more investment in businesses in the United States, and the existing businesses will benefit from the money that would have been given to the government in the form of tax can be diverted for use elsewhere, and this which might lead to more reinvestment in the country which will also make United states ones of the attractive country to do business in as the corporate tax rates will be low. United States of America already has some of the most significant companies, with some of the biggest companies by market cap, such as Apple, Nvidia, Meta, Tesla, Alphabet (Google), and many more. The Trump administration has also said to impose tariffs on different countries mainly Vietnam, China, Canada, While China has been in focus, President Trump has promised to impose 60% tariffs on China while this might lead to a chain reaction while disrupting supply chain , while China's economy has been struggling and has crossed more than 1 trillion dollars in surplus in trade this year, showing economies dependence on the export growth, while China has introduced various stimulus measures to boost the demand in the market while also providing support for the equity markets by imposing ban on short selling, incouraging institutions to buyback more shares, have provided a swap line for this, while the China's central bank has also after a long time has changed the stance of monetary policy after the great financial crisis showing the urgency of the crisis, while many are indicating that China might suffer the Japan growth mania, though it is unlikely as the China's market looks undervalued, while in the years after covid, the chinese government cracked down on different sectors which led to the stress in the equity markets while the real estate came as a surprise leading to the a long term of decrease in demand while covid measures also added to it, the household savings in China also increased at the same time, showing the retail investors appetite to keep money rather than invest or consume. Trump's policies are expected to be inflationary, while one of the views given is that the tariffs imposed can be fought by devaluing currency or depreciation of the domestic currency of a country as it will lead to an increase in the purchasing power of the other country as they will be able able to buy the same amount of goods with lesser prices. The inauguration is around the corner, so let's see what happens.

Equity Market:-

Let's take a look at the Weekly Foreign Institutional investors and Domestic institutional investors:-

This week, FIIs also sold approximately 25,218 crores in the cash market. In comparison, the DIIs bought 25,150 crores, showing how FIIs have sold in the cash market for a long time and from the previous week, the streak continue. DIIs have been net buyers at the levels where the indices are trading and the Nifty 50 P/E ratio at 21.4. The DIIs bought aggressively on Monday and Tuesday as the market saw a good fall on both days. Simultaneously, the FIIs sold aggressively this week, too.

Let's take a look at the Options segment:-

The option segment clearly shows how, at the level of 24000, the open interest is highest for the call holders, showing how it can act as major support going forward for Nifty 50. For the support levels, we can see the maximum number of Put writers at the level of 22700, which can act as support.

The PCR ratio remains at 0.8, which shows the market mood is slightly above the Bullish mood. ( PCR>0.7 BULLISH SIGNAL)

Let's take a look at what happened to the indices over this weekend:-

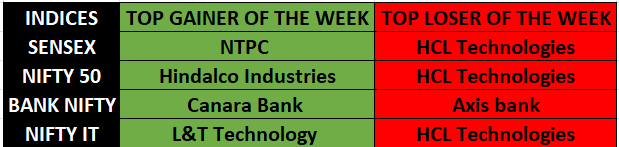

Sensex this week fell by approximately 0.98%, Nifty 50 fell by almost 0.97%, bank Nifty fell by 0.4%, and Nifty IT fell by 5.78%, showing the intense selling pressure in the markets this week. The image below shows the stocks of the particular indices and the top gainer and loser stocks in the past week of that index.

Technical analysis:-

The Nifty 50 moved in a channel while the chart has been changed from earlier ( Technical analysis is all about how clear charts can be while moving). The Nifty 50 has been moving in a channel while a breakout on either side can lead to bullishness or bearness in the market, while the Nifty on weekly time frame didn’t get close to the 50MA, showing the mood of the market. The Nifty will be closely traced on how it moves, and this channel will act as a major support and resistance for the index.

The next resistance and support levels to watch out for next week are:-

Support = 22790, 22503.

Resistance = 23363, 23938.

Bank Nifty closely followed the channel, and as it broke below the support level of the channels, the selling pressure intensified, while last week on a weekly time frame, bank nifty broke below the 50D MA and this week, as if the Index would have recovered then we would have thought of a pullback, while the Index looks bearish with macro factors at play, RBL reported bad earnings, while different banks are indicating increase in NPA which a bad sign as the MFI sector is showing stress.

Support levels = 46484, 46259.

Resistance levels = 49868, 53176.

The Nifty small-cap 250 Index is also consolidating. While the index recently broke below the support levels, after that, the index recovered sharply so that the breakdown levels could act as support. This index will be closely watched this week, and on the opening on Monday, while opening on Monday and a green candle above the high of Jan 10 shows strength in the index and if sustained, we might see the index making a new high, while the 50D 200D MA will also act as a resistance level.

From now on I will no more be suggesting which stocks to look at.

Debt Markets :-

The Yield on US02Y, US10Y, and US30Y bonds decreased this week by approximately 10 basis points, 14 basis points, and 9 basis points. Now, you may ask, what does it reflect?

Meanwhile, the US bonds of shorter term and longer term show the market expectations of the Federal Reserve interest rates as yields are directly proportional to the repo rate and inversely proportional to the bond’s price, i.e., when the bond price falls, the yield increases and vice versa.

The yields of the US02Y, US10Y, US30Y bond are as follows below in the chart :-

Commodities market:-

Gold has been consolidating after Trump was declared the winner, though Gold has hit new All time highs recently in INR terms. The next resistance levels will be keenly watched with the 2714, 2790, While on the support levels the 2602, 2539.

Some key insights and facts:-

Dependence on imported APIs & bulk drugs (72% from China) adds pressure. FY26 raw material costs expected to rise 5%. Exporters face global competition amid rising dollar

Wipro beats Q3 estimates, raises FY25 revenue guidance (-1% to 1%)! Revenue up 0.1%, profit up 4.5%, driven by US & BFSI demand. Headcount falls by 1,157, but AI spending & cost optimizations boost margins. Large deals pipeline strong.

Indian Hotels reports a 29% YoY profit surge to ₹582 Cr in Dec quarter, driven by consolidation of air and institutional catering business. Hospitality sector showing resilience!

Axis Bank stock sinks 6%, hits 52-week low at ₹974 after weak Q3 results. Credit costs rise to 86 bps, slowest deposit growth in 15 years, muted NIM & fee income. Brokerages slash price targets; HSBC at ₹1,170

SBI Life Q3 profit surges 71% YoY to ₹551 Cr on strong growth in new & renewal premiums. Persistency improves to 86%. ICICI Lombard Q3 profit jumps 68% YoY to ₹724 Cr, driven by premium growth & better solvency ratio at 2.57x

Govt mulls ₹1L+ Cr AGR dues waiver: 50% on interest, 100% on penalties. Vodafone Idea to benefit most (~₹52K Cr), Airtel ~₹38K Cr. Relief could bring AGR dues to ₹40K Cr, aiding telcos' financial health. Announcement likely in Budget. Positive for Indus tower.

Rupee depreciation hits pharma sector, Paint sector as input costs rise! .